CURRENTLY CURRENT! Questions and answers about volume insurance!

What is VH Latvia?

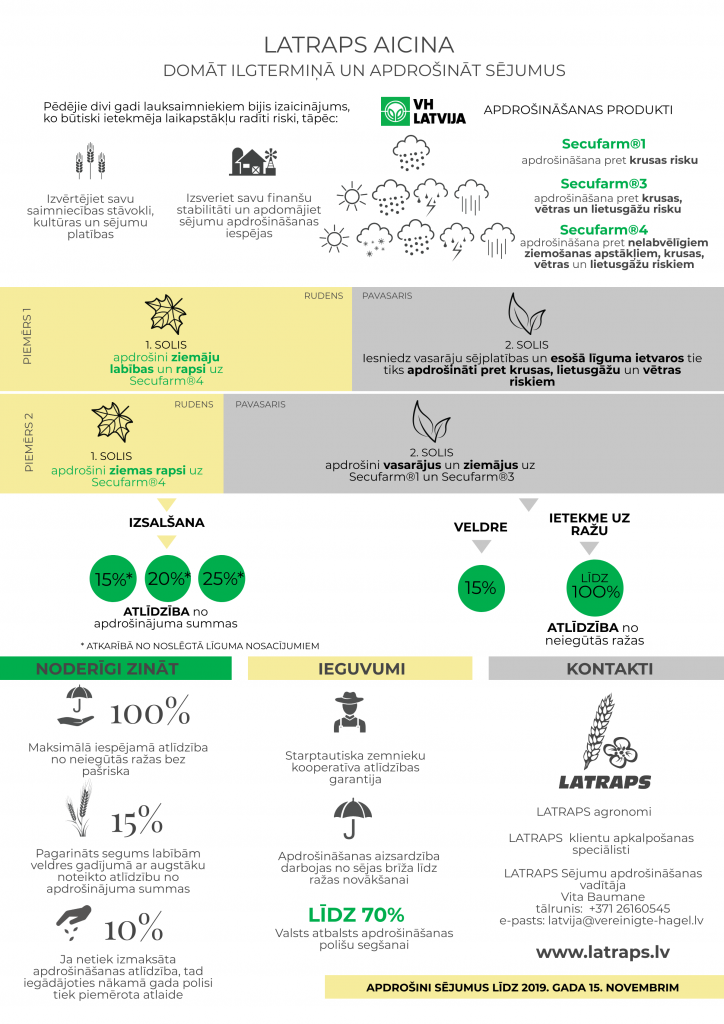

International Farmers' Mutual Insurance Cooperative United Hail (VH Latvia) entered Latvia in 2012. The entry was facilitated by LATRAPS becoming an agent of the German mutual insurance company and performing support functions in Latvia. LATRAPS and VH Latvia have set the development of crop insurance as an important long-term goal, so that farmers have the opportunity to reduce losses caused by climate risks.

What risks does insurance cover?

Insurance covers hail, storms, torrential rain, the effects of adverse winter conditions, catastrophic drought losses caused by the occurrence of an insured event, resulting in a quantitative and, in the case of certain crops, a qualitative reduction in the yield. as a result of prolonged rain, a fixed compensation for losses is paid, regardless of the actual amount of losses.

What is not covered by insurance?

The insurer is not liable for losses that, for example:

- are consequences of the insured risks and already exist at the time the insurance takes effect, or existing risks;

- occurred because the basic principles of good housekeeping were violated;

- caused by plant diseases or pest damage, regardless of contributing factors and regardless of whether they are a consequence of the occurrence of an insured event.

Are there any limitations to insurance coverage?

! If the level of damage in the field has reached at least 8%, then up to 100% of quantitative loss of yield is compensated.

There are exceptions to this regulation that apply to certain plant species or crop groups, risks, as well as plant development stages. For example, losses resulting from adverse wintering conditions and crop veld are compensated with a certain amount of compensation (as a percentage of the insured amount) agreed upon when concluding the insurance contract.

What new features have come into effect for the 2019 fall season!

! In the event of a catastrophic drought, a fixed compensation of -20%, 40% or 60% is paid, depending on the extent of the damage. In the event of prolonged rain, the maximum compensation amount is 10% of the relevant field insurance amount.

Where does insurance work?

Does the insurance work on all fields on the farm?

The insured area is the area managed by the policyholder's company to which the insurance contract applies. It can be all fields or just some.

What should be taken into account when taking out insurance, what are the contractual obligations?

The policyholder is obliged to:

- inform the insurer about the risk factors that are essential for concluding an insurance contract;

- to inform about the change of ownership of the farm;

- Insure crop yields with a single insurer that offers coverage for crop yield losses;

- submit a sowing/planting plan and related changes.

- make a payment for the policy;

- 3 working days to inform about the occurrence of risk in a timely manner;

- participate in loss assessment and take risk mitigation measures.

When does insurance coverage begin and end – the risks provided for in the insurance contract and the events in which the insurer is obliged to pay compensation?

- The decisive factor for insurance protection to take effect is the information specified in the offer, as well as in the policy.

- Within the scope of the insurance package, different coverage periods may be specified for individual insured risks.

- The insurer's liability ends upon the harvest of the insured crop or the clearing of the insured area, early harvest or other non-existence of the insured object.

How can you insure your crops?

Insurance applications can be submitted electronically – https://ej.uz/LATRAPS-apdrosinasana

As well as in person, at all LATRAPS offices.

For more information about crop insurance products and their conditions, please contact LATARPS Crop Insurance Manager Vita Baumane, phone +371 26160545, e-mail latvia@vereinigte-hagel.lv

The volume insurance period in autumn is 01.10.2019. – 15.11.2019.

LATRAPS Members and VH Latvija clients about their volume insurance experience.

Latvian Grain, SIA owner Elvis Lazdins: "I have been insuring crops for six years now and I do it to reduce risks as much as possible. I insure against both winter and summer risks. Farmers cannot change the weather conditions, but we can insure crops and thus reduce losses. I estimate that in the fall we make investments that reach up to 300 euros per hectare. Therefore, I recommend insuring crops, spreading the risks, and taking care of yourself and your farm."

Owner of Katlauki z/s Andis Vicinskis: "We have been VH Latvija customers since 2013. Of course, we have always wondered if it was worth it.? This year we were still thinking - is it really necessary, because all the time it's just investments? But this one year proved that one unsuccessful season is enough for everything invested with compensation for losses to be paid back with a bang!"

Valters Bruss, owner of Silāres, SIA and Strazdi z/s: “We have been insuring our crops from day one and I am glad that we have the opportunity to do so. This is a safe way to insure our income, because there is no reason to think that climate risks will become less. Another reason – insured crops allow you to sleep better at night!”