Tax regime relaxed for seasonal agricultural workers

We remind you that farmers have the opportunity to use a simplified labor tax regime for seasonal workers, paying only 15 percent labor tax for them and significantly reducing the administrative burden. This is stipulated by law. "About personal income tax". This preferential tax regime can be used by an employer (farmer) who uses agricultural land owned, permanently used or leased for growing fruit trees, berries or vegetables and has applied for the single area payment in the current year.

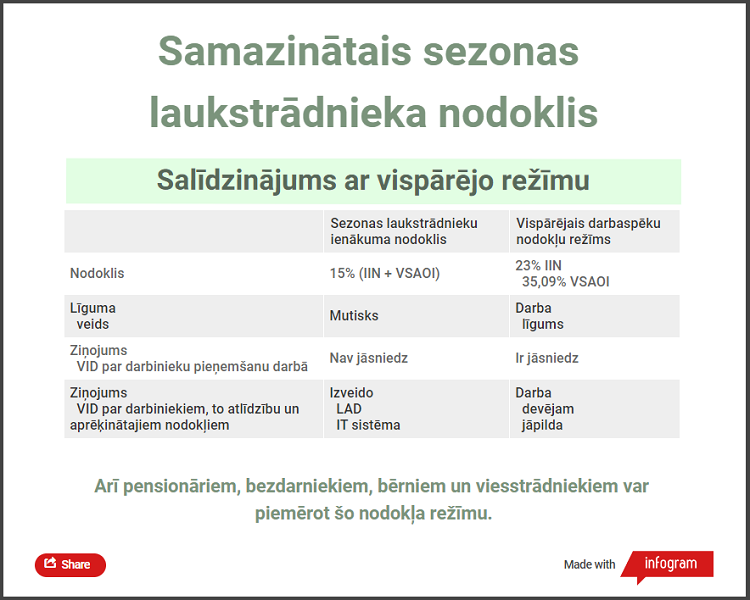

Informative schedule “Reduced seasonal agricultural worker tax”

The seasonal agricultural worker income tax regime may be applied to a seasonal agricultural worker (employee) who is employed from April 1 to November 30 and works in seasonal work - sowing or planting fruit trees, berry trees and vegetables, caring for crops and plantations, harvesting, sorting fruits, berries and vegetables.

The maximum period of employment for which a seasonal agricultural worker can be subject to this special income tax regime cannot exceed 65 days of work (in the period from April 1 to November 30), and the maximum income of a seasonal agricultural worker cannot exceed EUR 3,000. If any of these limits are exceeded, an employment contract can be concluded with the seasonal agricultural worker (employee) and labor taxes are paid according to the general procedure.

The seasonal agricultural worker's income tax is 15 percent of the agricultural worker's earned wages, but not less than 0.70 euros for each day worked. A seasonal agricultural worker (employee) becomes socially insured for a pension if the monthly income earned by one or more employers exceeds 70 euros. We remind you that this tax regime can also be applied to pensioners, the unemployed, children and migrant workers. In addition, when employing children, parents retain the personal income tax relief for dependents.

An employer (farmer) who employs seasonal agricultural workers must submit a report on the employed persons, their income and the calculated income tax to the State Revenue Service (SRS) once a month. He must use the Rural Support Service (RSS) information system, registering seasonal agricultural workers, the date of income generation, the form of the concluded contract and the calculated remuneration for work for seasonal agricultural workers. The RSS information system automatically calculates the income tax of seasonal agricultural workers. On the day after the last day of the month of employment, the RSS information system allows employers to obtain all data entered into the RSS information system during the month and the calculated tax amount in a summarized form for submission to the SRS.

Cabinet of Ministers Regulation No. 25/2014 of 25 March 2014 166 “Regulations on the Rural Support Service Information System for Ensuring the Application of Income Tax for Seasonal Agricultural Workers” determines that an entrepreneur has access to the RSS information system if the employer (farmer) who employs seasonal agricultural workers has indicated at least one of the crop codes listed in the annex to the regulations in the single area payment application.

The introduction of the seasonal agricultural workers' income tax regime has been successful, as the objectives of this tax have been achieved – to reduce illegal employment among seasonal agricultural workers and to reduce the administrative and financial burden on employers (fruit, berry and vegetable producers) associated with the uneven flow of seasonal workers characteristic of the sector. The income of seasonal agricultural workers is also increasing every year. The average income per agricultural worker in 2018 was 444 euros, which is 21 percent more than in 2017. The amount of taxes paid to the state budget has also increased accordingly, and young people in the age group from 16 to 25 years earn the most.

The Ministry of Agriculture calls on farmers to use the preferential labor tax regime, as certain criteria must be met in order for the seasonal agricultural worker income tax regime to be extended beyond 2020. The Ministry of Agriculture believes that in the future it is necessary to expand the scope of the seasonal agricultural worker income tax regime and provide the opportunity to apply it to other areas of agriculture, for example, in animal husbandry and crop production.

Informative graphic “With seasonal agricultural worker tax – a lower tax burden for the employer”

Source: Ministry of Agriculture